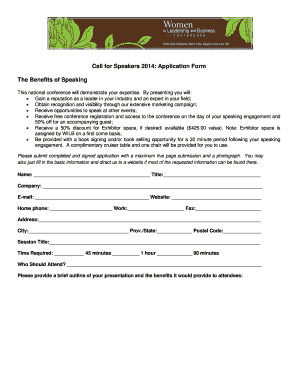

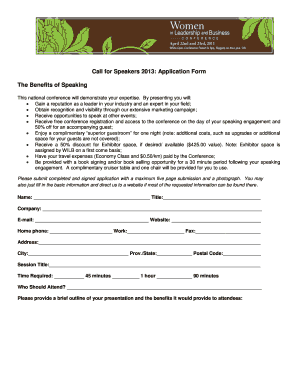

Canada IBC Claim Form No. 3 HST 2013-2025 free printable template

Get, Create, Make and Sign canada ibc form

How to edit ibc form 3 online

Canada IBC Claim Form No. 3 HST Form Versions

How to fill out ca form 3 release

How to fill out Canada IBC Claim Form No. 3 HST

Who needs Canada IBC Claim Form No. 3 HST?

Video instructions and help with filling out and completing form final release ontario

Instructions and Help about ibc claim 3

Hi I'm the IBC manager with Buck horn Today I am going to demonstrate how to insert form fit liner fill it and dispense it in the Buck horn liquid IBC container This container is unique because it holdup to 315 gallons of liquid or 3300 pounds capacity and is railcar approved The container holds a variety of liquid products So lets get started first thing you want to do is remove the lightweight lid and set up the side walls Now that the container is set up you will want to get your liner ready to be inserted You're going to want to unfold the liner sits roughly the same size as the bottom of the container The one key step to this is to pull the bottom fitment away from the liner so that the liquid has ample room to flow out of the bottom of the liner You're going to hold the one side of the bag Take the bottom fitment and pull that away from the liner and that will give it the area to flow out Now that the liners ready to go you want to remove the bottom bubble wrap and insert the liner To do this grab the liner from each side and were gonna line up the bottom port of the liner with the bottom sump area of the Caliber Then you'll come down grab the bottom Portland pull the gland adaptor through until you hear it click then you'll know its in secure The next step to this is to grab a standard grabber and make sure that all the corners of the bag are in the corner of the caliber This will insure a proper fill Now were going to grab a fill bridge and this sits across the top of the Caliber, and it will hold the top portion of the liner should be ready to fill Again you can use a standard grabber to grab the top fitment you're going to want to take the bubble wrap off it as well You're going to pull it up and insert it into the fill bridge and shut the gate Now the last step is to take the top portion off grab the cam lock adaptor Screw that into the top of the liner Then grab your filling mechanism hook ITU to the top make sure its secure, and now you're ready to fill the container Now that the container is filled and you puttee top cap back on the liner you can remove the fill bridge Next you'll want to put the lid on Then go ahead and secure all the locking lids Now that the locking mechanisms are in place you can put a secure tie down on the locking mechanism for a more secure shipment The nice thing about the Caliber IBC shipment is you can fit up to 56 fully loaded on a 53 trailer or 168 collapsed and you canals ship it by rail because it is railcar approved Now that the product is at its end destination it's time to dispense First you'll want to remove the lid And you're going to grab a valve and a valve adaptor You're going to want to screw the valve adaptor on and this is the piece that is actually going to go inside the container and pierce the liner with the cutter Now you'll want to remove the bottom cap from the liner and pull out the cutter has sharp teeth on one side You're going to want to take that turn it tithe inside the...

People Also Ask about hst 4m 3

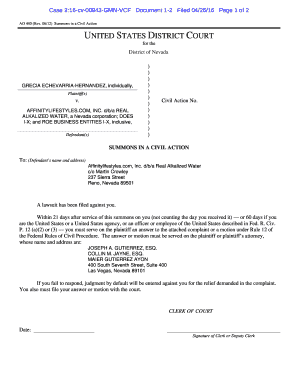

How long does an insurance company have to reject a proof of loss?

What does IBC do for insurance?

What is the Proof of loss rule?

What is an IBC form?

How to fill out automobile proof of loss form ontario?

How many days does an insurance company have to reject a claim?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

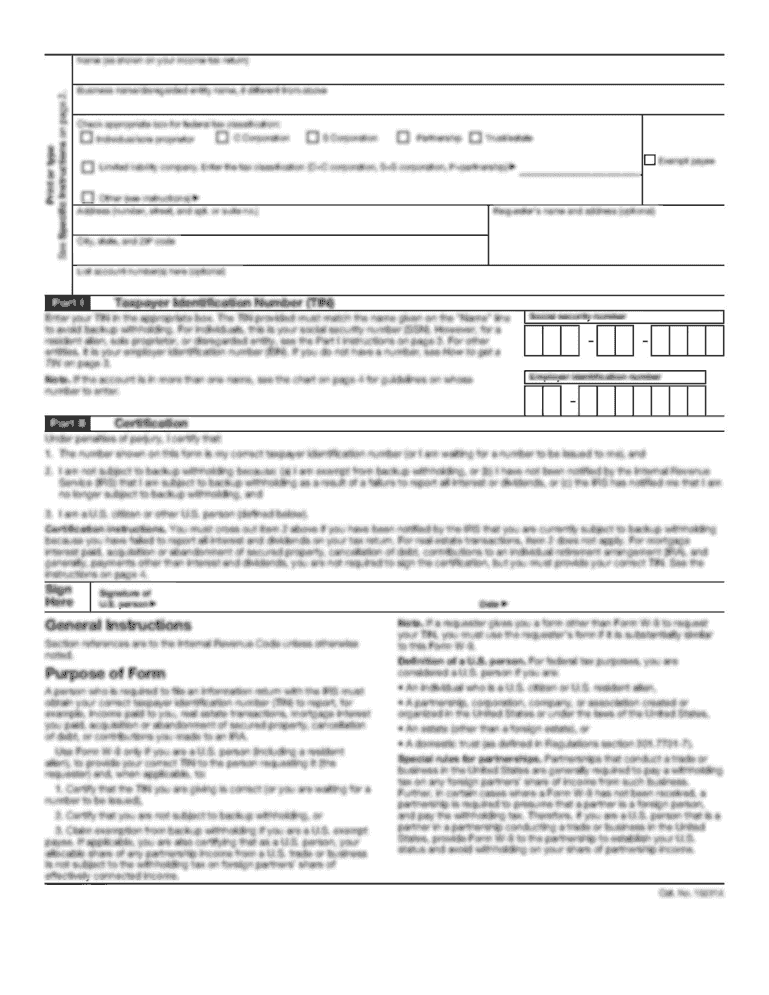

How do I edit Canada IBC Claim Form No 3 HST online?

Can I create an eSignature for the Canada IBC Claim Form No 3 HST in Gmail?

How do I fill out the Canada IBC Claim Form No 3 HST form on my smartphone?

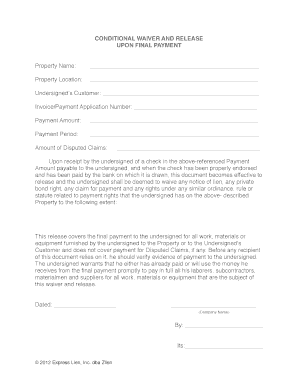

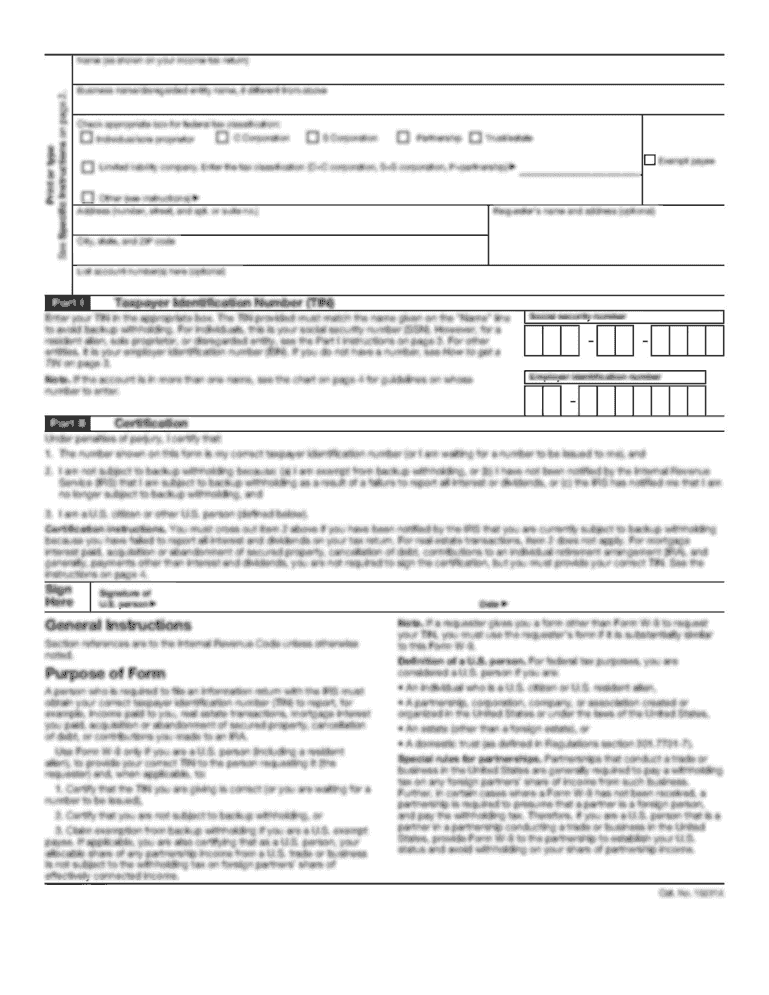

What is Canada IBC Claim Form No. 3 HST?

Who is required to file Canada IBC Claim Form No. 3 HST?

How to fill out Canada IBC Claim Form No. 3 HST?

What is the purpose of Canada IBC Claim Form No. 3 HST?

What information must be reported on Canada IBC Claim Form No. 3 HST?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.